Firm registration (pvt limited/LLP/propeatership)

1. Private Limited Company (PLC) Registration

What is a Private Limited Company?

A Private Limited Company is a business structure incorporated under the Companies Act, 2013, offering limited liability to its shareholders. It’s a separate legal entity, meaning the company can own assets, incur liabilities, and enter contracts independently of its owners. It’s ideal for businesses planning to scale or attract investors with Firm Registration.

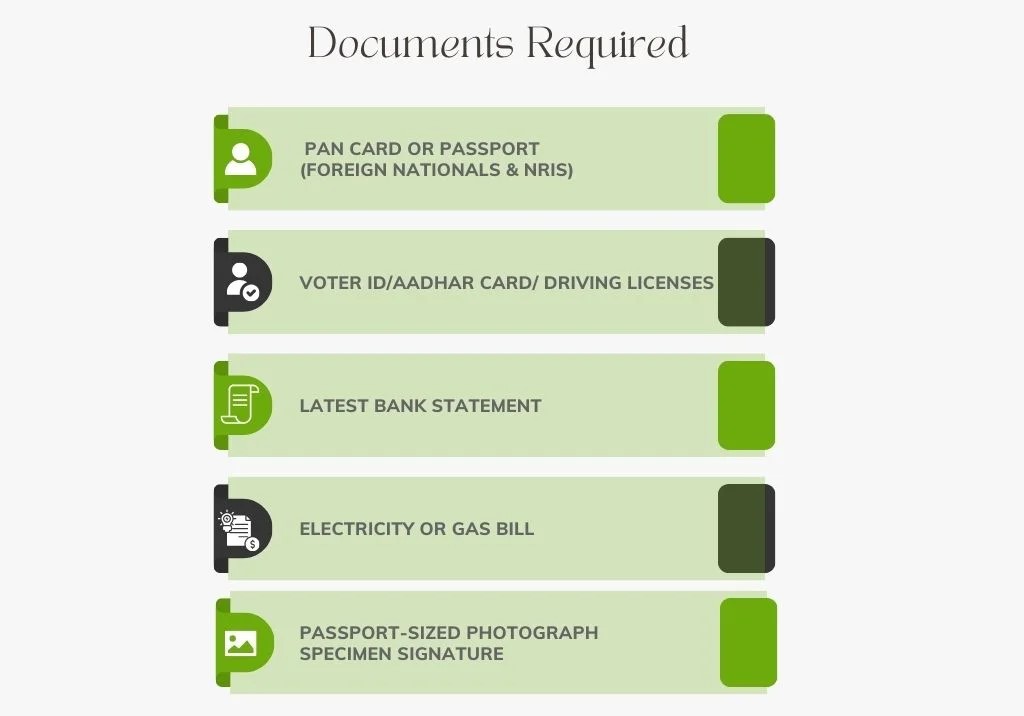

Documents Required

- PAN and Aadhaar of directors/shareholders.

- Address proof of registered office (e.g., rent agreement, utility bill).

- No Objection Certificate (NOC) from the property owner if rented.

- Passport-sized photographs of directors.

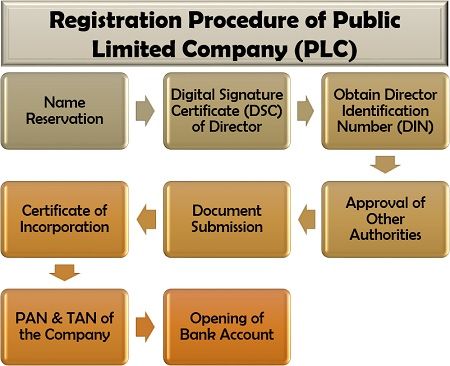

Registration Process

- Obtain Digital Signature Certificate (DSC): At least one director needs a DSC for e-filing. Apply through a certifying authority (₹1,000-₹2,000).

- Apply for Director Identification Number (DIN): Each director requires a DIN, applied via the SPICe+ form on the MCA portal.

- Name Reservation: Propose 1-2 unique names via SPICe+ Part A on the MCA portal (e.g., “Digimedia Solutions Pvt. Ltd.”). Approval takes 2-3 days.

- File SPICe+ Form: Submit SPICe+ Part B with details like registered office address, MoA (Memorandum of Association), AoA (Articles of Association), and director/shareholder information. Attach documents and pay the fee (₹5,000+ for ₹1 lakh capital).

- Certificate of Incorporation (CoI): Upon approval (7-10 days), the MCA issues a CoI with a Company Identification Number (CIN).

- PAN/TAN and Bank Account: PAN and TAN are auto-generated; open a company bank account to start operations.

2. Limited Liability Partnership (LLP) Registration

An LLP is a hybrid structure under the Limited Liability Partnership Act, 2008, combining the flexibility of a partnership with the limited liability of a company. It’s a separate legal entity, offering liability protection to partners while allowing operational flexibility.

Documents Required

- PAN and Aadhaar of designated partners.

- Address proof of registered office (e.g., utility bill, rent agreement).

- NOC from the property owner if rented.

- LLP Agreement (detailing profit-sharing, roles, etc.).

Registration Process

- Obtain DSC and Designated Partner Identification Number (DPIN): At least two designated partners need DSC and DPIN (similar to DIN).

- Name Reservation: Apply for a unique name via the RUN-LLP form on the MCA portal (e.g., “Digimedia Solutions LLP”). Approval takes 1-2 days.

- File LLP Agreement and Form FiLLiP: Submit Form FiLLiP for incorporation, including partner details, and file the LLP Agreement (Form 3) within 30 days of incorporation. Attach documents and pay the fee (₹1,500-₹5,000).

- Certificate of Incorporation: Upon approval (5-7 days), the MCA issues a CoI with an LLP Identification Number (LLPIN).

- PAN/TAN and Bank Account: Apply for PAN/TAN and open a bank account to start operations.

3. Sole Proprietorship Registration

A Sole Proprietorship is a business structure owned and operated by a single individual, with no legal distinction between the owner and the business. It’s the simplest form of business, requiring minimal formalities, but it offers no liability protection.

Documents Required

- PAN and Aadhaar of the owner.

- Address proof of the business (e.g., rent agreement, utility bill).

- NOC from the property owner if rented.

- Business name proof (e.g., utility bill in the business name).

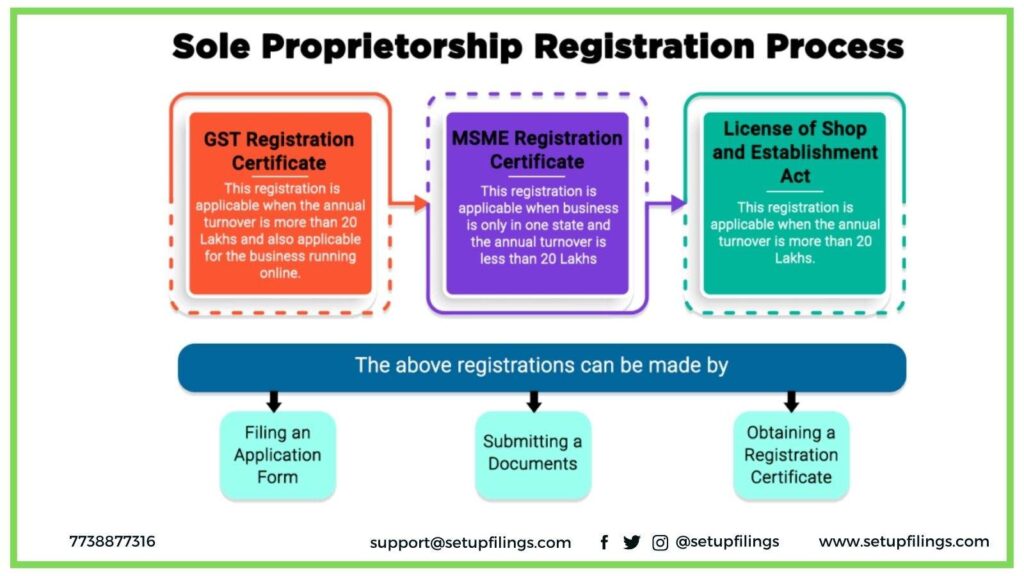

Registration Process

There’s no formal “registration” for a sole proprietorship under a specific act, but you need certain licenses to operate legally:

- Obtain PAN Card: Use your personal PAN for tax purposes.

- Register for GST (if applicable): Mandatory if turnover exceeds ₹40 lakh (₹20 lakh in special category states) or for interstate supplies.

- Apply for Licenses: Depending on your business, apply for:

- Shop and Establishment License (under state laws).

- MSME Registration (optional, for benefits like subsidies).

- Professional Tax Registration (if applicable).

- Open a Bank Account: Open a current account in the business name (e.g., “Digimedia Solutions”).

The process takes 3-7 days, depending on the licenses required.

4. Partnership Firm

- Definition: A business owned by two or more individuals who share profits, losses, and responsibilities based on a partnership agreement.

- Liability: Unlimited for general partners unless specified otherwise in the agreement.

- Registration: Optional in many jurisdictions (e.g., under the Indian Partnership Act, 1932). Registered with the Registrar of Firms (RoF) in the relevant state or region by submitting a partnership deed and Form 1.

- Best For: Small teams, such as content creation agencies or marketing partnerships.

- Advantages: Shared responsibility, easy to form, registered firms gain legal benefits (e.g., ability to sue).

- Disadvantages: Unlimited liability, potential disputes among partners.

Types of Partnerships

- General Partnership:

- All partners have equal rights, responsibilities, and unlimited liability.

- Most common form for small businesses.

- Limited Partnership (less common in some jurisdictions like India):

- Includes general partners (unlimited liability) and limited partners (liability capped at their investment).

- Requires specific registration under laws like the Limited Partnership Act, where applicable.

- Partnership at Will:

- No fixed duration; can dissolve when a partner exits or by mutual consent.

- Particular Partnership:

- Formed for a specific project or time period (e.g., a marketing campaign), dissolving afterward.

5. One Person Company (OPC)

- Definition: A single-owner company with limited liability, introduced to support solo entrepreneurs (e.g., under India’s Companies Act, 2013).

- Liability: Limited to the capital invested; personal assets are protected.

- Registration: Mandatory with the Registrar of Companies. Requires a nominee (to take over in case of the owner’s death or incapacity) and incorporation filings.

- Best For: Solo content creators or marketers wanting a formal structure with liability protection.

- Advantages: Limited liability, separate legal entity, easier than a PLC.

- Disadvantages: Limited to one owner, moderate compliance.

Key Features

- Single Owner: Only one natural person (resident of India, in the Indian context) can be the shareholder.

- Nominee Requirement: A unique feature—another individual must be appointed as a nominee to take over the company if the owner dies or becomes incapacitated.

Liability

- Limited Liability: The owner’s liability is restricted to the amount of capital they invest in the company. Personal assets (e.g., home, savings) are protected from business debts or losses, unlike a sole proprietorship.

- Exceptions: Liability may extend personally if the owner engages in fraud, misrepresentation, or fails to comply with legal obligations (e.g., not maintaining proper records).

- Contrast: Offers more protection than a partnership or sole proprietorship but aligns with the liability structure of a private limited company.

6. Public Limited Company

- Definition:A Public Limited Company (PLC) is a business entity that can offer its shares to the general public and has no upper limit on the number of shareholders. It is designed for large-scale operations and is typically associated with companies seeking significant capital through public investment, often with the potential to list on stock exchanges. Liability: Limited to share contributions.

- Registration: Mandatory with a central authority (e.g., Registrar of Companies). Requires more extensive documentation and compliance than a PLC.

- Best For: Large-scale content or marketing firms aiming for public funding or stock market listing.

- Advantages: Access to public capital, high credibility, scalability.

- Disadvantages: Complex compliance, public disclosure requirements.

Key Features

- Public Share Offering: Can issue shares or debentures to the public via an Initial Public Offering (IPO) or subsequent offerings.

- Minimum Requirements: In India, requires at least 7 shareholders, 3 directors, and a minimum paid-up capital (previously ₹5 lakh, but no strict enforcement post-2015 amendments).

- Stock Exchange Listing: Optional but common; listed PLCs trade shares on exchanges (e.g., BSE, NSE), while unlisted PLCs can still raise public funds without listing.

- Separate Legal Entity: The company owns assets, incurs liabilities, and enters contracts independently of its shareholders.

Liability

- Limited Liability: Shareholders’ liability is restricted to the value of their share contributions. Personal assets are protected from business debts or losses unless fraud or personal guarantees are involved.

- Contrast: Similar to a Private Limited Company or OPC but differs from partnerships or sole proprietorships, where liability is unlimited.

- Risk Distribution: Liability is spread across a potentially vast number of shareholders, reducing individual exposure.

7. Section 8 Company (Non-Profit)

- Definition:A Section 8 Company is a specialized business entity formed under the Companies Act, 2013 in India (Section 8), designed to promote charitable, educational, scientific, artistic, religious, or social welfare objectives. Unlike profit-driven companies, it reinvests all profits and income back into its stated mission rather than distributing them as dividends to shareholders.

- Liability: Limited.

- Registration: Mandatory with the Registrar of Companies, requiring a license from the government to operate as a non-profit.

- Best For: Content creators or marketers focused on social impact or education.

- Advantages: Tax exemptions, credibility for social causes.

- Disadvantages: Restricted to non-profit goals, no dividends.

Key Features

- Non-Profit Nature: Prohibited from paying dividends; surplus funds must support its objectives.

- Limited Liability: Shareholders’ liability is capped at their contribution (usually nominal).

- Separate Legal Entity: Exists independently of its members, with perpetual succession.

- Minimum Requirements: In India, requires at least 2 shareholders and 2 directors (for private Section 8) or 7 shareholders and 3 directors (for public Section 8).

- Naming Convention: Must include “Foundation,” “Association,” “Society,” “Council,” “Institute,” or similar terms, but not “Limited” or “Private Limited” unless specified.

Liability

- Limited Liability: Members’ financial responsibility is limited to their subscribed capital or guarantee amount (often nominal, e.g., ₹1,000). Personal assets are protected from organizational debts or losses.

- Exceptions: Liability may extend personally if fraud, mismanagement, or misuse of funds occurs, violating the non-profit mandate.

- Contrast: Offers the same liability protection as other companies (e.g., OPC, PLC) but differs from trusts or societies, where liability depends on structure.

GST REGISTRATION

What is GST Registration

Goods and Services Tax (GST) registration is the process by which a business in India obtains a unique 15-digit GST Identification Number (GSTIN) to collect GST on behalf of the government and claim input tax credits for GST paid on purchases. Introduced in 2017, GST replaced multiple indirect taxes like VAT, service tax, and excise duty, aiming to simplify taxation for businesses. It’s a mandatory requirement for certain businesses and voluntary for others, depending on turnover and business type.

Who Needs to Register for GST

GST registration is required for:

- Businesses with an annual turnover exceeding ₹40 lakh (₹20 lakh for special category states like Northeastern states, Himachal Pradesh, and Uttarakhand, or ₹10 lakh for specific cases).

- Entities involved in interstate supply of goods or services, regardless of turnover.

- E-commerce sellers or those supplying through e-commerce platforms.

- Non-resident taxable persons, casual taxable persons, or those paying tax under the reverse charge mechanism.

- Businesses providing online information and database access from outside India to Indian customers.

- Any business voluntarily opting for GST registration to avail input tax credits, even if below the turnover threshold.

Benefits of GST Registration

- Legal Compliance: Avoid penalties for non-registration, which can be 10% of the tax due or ₹10,000 (whichever is higher), or 100% of the tax due in cases of tax evasion.

- Input Tax Credit: Claim credits for GST paid on business expenses, reducing overall tax liability.

- Interstate Business: Enables seamless interstate trade without tax barriers, as GST is a unified tax system.

- Credibility: A GSTIN enhances your business’s legitimacy, making it easier to work with larger clients or e-commerce platforms.

- Transparency: GST registration ensures proper tax documentation, fostering trust with customers and vendors.

Fssai registrations

Fees

- Basic Registration: ₹100 per year.

- State License: ₹2,000-₹5,000 per year (varies by state and business type).

- Central License: ₹7,500 per year.

Note: Fees are paid for the chosen validity period (1-5 years). For example, a 5-year State License at ₹2,000/year costs ₹10,000.

Who Needs FSSAI Registration?

- Any business involved in manufacturing, processing, packaging, storing, transporting, distributing, importing, or selling food products (e.g., restaurants, food manufacturers, caterers, retailers, or e-commerce food sellers).

- Turnover/Capacity-Based Categories:

- Basic Registration: For FBOs with an annual turnover up to ₹12 lakh (e.g., small food vendors, hawkers, petty retailers).

- State License: For FBOs with turnover between ₹12 lakh and ₹20 crore (e.g., medium-sized restaurants, food manufacturers, or storage units).

- Central License: For FBOs with turnover above ₹20 crore, or those operating in multiple states, importing/exporting food, or dealing with specific categories (e.g., large food chains, 100% export units, or businesses in central government premises).

Registration Process

- Determine License Type: Identify whether you need Basic Registration, State License, or Central License based on your turnover, scale, and operations.

- Apply Online via FoSCoS Portal: Visit foscos.fssai.gov.in, select “Apply for License/Registration,” and choose your business type (e.g., manufacturer, retailer).

- Fill Application Form:

- For Basic Registration: Use Form A.

- For State/Central License: Use Form B.

Provide details like business name, address, food category, turnover, and production capacity.

- Upload Documents: Submit required documents (listed below) and pay the applicable fee.

- Inspection (if applicable): For State and Central Licenses, an FSSAI officer may inspect your premises to verify compliance with safety standards (e.g., hygiene, storage conditions). Basic Registration typically doesn’t require an inspection.

- Receive License/Registration: Upon approval (7-60 days, depending on the license type), you receive an FSSAI License/Registration Number and certificate, valid for 1-5 years (renewable).

Total Time:

- Basic Registration: 7-15 days.

- State/Central License: 30-60 days (due to inspection).

Documents Required

- For Basic Registration:

- Photo ID and address proof of the owner (e.g., Aadhaar, PAN, voter ID).

- Business address proof (e.g., rent agreement, utility bill).

- Declaration of food safety compliance (self-declaration form).

- Photograph of the owner.

- For State/Central License (Additional):

- Business registration proof (e.g., Certificate of Incorporation for PLC, partnership deed for LLP).

- List of food products and categories to be handled.

- Food Safety Management System (FSMS) plan or certificate (e.g., HACCP plan for manufacturers).

- Source of raw materials and water test report (for manufacturers).

- Layout plan of the premises (for State/Central License).

- NOC from the local municipality or health department (if applicable).

Business Growth

_____________

Enables participation in government tenders or contracts that require FSSAI compliance.